Insurance has traditionally been a service that has always face to face interaction for client satisfaction, There is a series of exchanges of questions and answers and a lot of negotiation. Thanks to the development of the e-commerce channels and changing consumer behaviour, buying personal insurance online has come far from its traditional reality. Insurance brokers in India have also transitioned through this phase.

In short, buying individual/personal insurance online has been normalized to a good extent.

But corporate/business insurance still has a lot of catching up to do.

And as a startup, it can be a tad bit tedious for you to take care of your business’s insurance needs which is not the case with bigger businesses.

So If you are a start-up or an MSME business that wants a business insurance product, let’s say, a fire insurance cover then obviously, being a startup you don’t have enough time to take care of secondary tasks like buying insurance for your business.

So where should a start-up buy their business insurance to save both their time and money?

Enter JInsurance.in India’s first 100% online business/corporate insurance brokers that provide:

- One-stop solutions for all types of insurance needs

- Innovative and low-cost insurance solutions

- Insurance solutions optimized as per your requirements

- Quick and Hassle-free claim settlements

- And the best part is instant quote generation from all the companies in a single click

Now with J Insurance, you get a dedicated broker who takes care of your account right from helping you choose the best insurance policy to settling any claims when needed.

But why choose J Insurance?

But it’s not just our value proposition that will serve you great. Our employees are always there to provide you with the best services from choosing the best policy for you to settling your claim.

And here are the reasons for that:

- We put your needs first: We are two decades plus institution and thus we strive for a long term relationship with our client that is based on a pristine after-sales service.

Thus, we’d always look to optimize your insurance requirement and recommend options that best fit your requirements.

- Excellent service to customers: Our insurance executives are people you can get hold of and rely on. They will respond timely to your calls and messages. With excellent customer service and support, you can be at peace and be assured that you will be helped and heard.

- Complete knowledge of all products: Every J Insurance employee has complete knowledge of our wide range of insurance products. They are IRDA qualified broker verified personnel and supported by an experienced team that is qualified as Licentiates and Associates in Insurance. And this is the reason why we are able to provide you with comprehensive detail about all the business insurance products that are a right fit for you.

- Technically sound: Our executives’ skills are not just limited to providing you with “The” policy that you require. In fact, they are also technically sound with the rules of insurance that dictate your purchase decisions when it comes to buying insurance.

- Emotional and listening skills: In the insurance industry, it is quite important for an executive to have emotional skills to listen and understand clients by connecting with them and eventually figuring out “what they really want?” Our employees have full knowledge of how to deal with their clients with respect to their current situation.

- Honest: Every J Insurance executive is far from deceiving or tricking you to buy into a faulty insurance product. They will always keep everything upfront and present only the truth.

- Always enthusiastic: When a person buys a service or a product, as a customer you’d always expect the person attending to you to be enthusiastic about what they are doing. It’s simple if the agent isn’t the world about the product then you wouldn’t be either.

That was all about us as Insurance brokers and the reasons that you can trust us. Just to add a bit more about the credibility of all our employees. We’d also like to tell you the fact that all our insurance personnel are mandated by IRDA as "Principal officer/Broker verified Personnel" & seniors are Associates from the Insurance Institute of India, Mumbai.

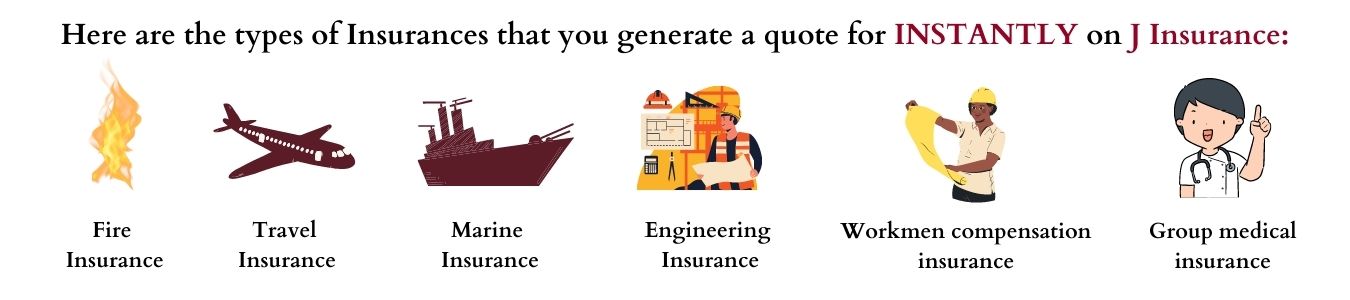

Types of Business Insurance Policies that you can buy online:

Just like a big business that has insurance partners who can make different types of Insurance policies readily available in an instant for them. Startups can also have that luxury and that too online. Through J Insurance’s platform, you can buy any kind of business insurance policy and get the best quote by a quick comparison done by us to showcase the best deal to you.

Here are the types of Insurances that you generate a quote for INSTANTLY on J Insurance:

- Standard Fire & Special Perils Insurance

- Travel Insurance/Overseas Mediclaim

- Marine Insurance

- Engineering Risk Insurance

- Workmen Compensation Insurance

- Group Medical Insurance (& Group Personal Accident)

And here are policies that you can buy directly by reaching out to us.

- Liability Insurance

- Corporate Motor Fleet Insurance

- Group Term Life Insurance

- Trade Credit Insurance

- Customized Insurance Packages

- Specially curated Insurance for your requirements

How to buy the best business insurance online?

In a normal scenario, you’d have to pick your brains out in research to find out the best business insurance policy online and as a startup when your core business needs the most of your attention you can’t fixate yourself on the insignificant hassle of buying insurance.

To buy the best business insurance without wasting your time. All you have to do is go follow these steps.

- Open a browser and visit J Insurance

- In the menu, click on Insurance and different business insurance products will show up

- Click on the insurance product that you are looking for, let’s say, you were looking for Standard Fire and Special Perils Insurance

- Here on the Insurance product page, you can thoroughly read all the details about the Insurance product you are going to buy. For eg: You can check out what coverages you get, what are the exclusions, and what are the add-ons that you can opt for

- Now If you want to proceed further, then you can simply scroll to the “Get a Quote” section and click on “Start Saving”

- Once you click that, you will move to the next page and you’ll see a form-cum-calculator

- By filling in some basic details and the value of the asset that you want to insure. You have to click the “Next” button

- And “Voila”! You’ll get an instant quote from a variety of insurance companies right in front of you. You can then compare and choose a policy that fits your requirement

So there you have it. We hope we have informed you enough on how you as a startup can buy the best business insurance policy online without the need of a dedicated insurance partner, saving both your time and money.