Buy Property, Stock, Asset Insurance policy at the best prices, Now !

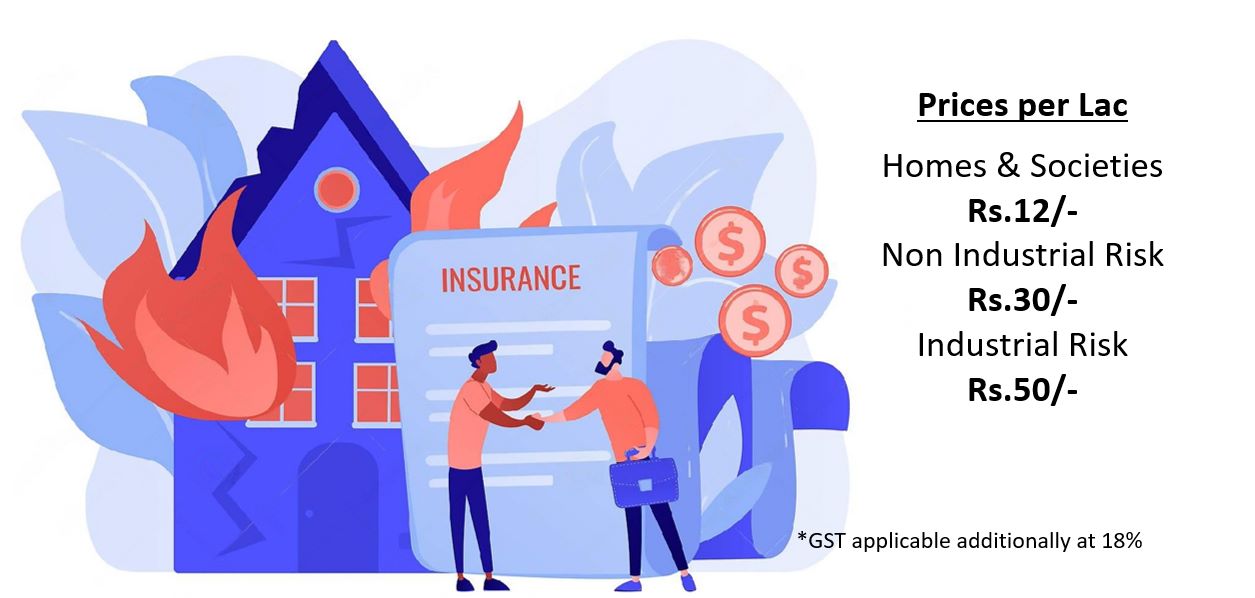

We, at JInsurance.in, are pleased to offer you Property, Asset, Stock or Fire Insurance to safeguard your belongings at the cheapest rates in the industry. Non-Industrial risks can be insured at as low as Rs.30 per lac of Sum Insured and Industrial risks at Rs.50 per lac of Sum Insured. You can check the rates in the calculator on this page

Fire Insurance is a lifesaver and a must-have. It protects your property against any loss caused due to the below mentioned perils. The coverages that are provided in a typical Fire Insurance Policy are;

- Accidental Fire

- Earthquake cover

- Storm, Tempest, Flood, inundation cover (STFI) or Any Act of God

- Riots, Strikes & Malicious Damage cover (RSMD)

- Terrorism Cover

- Burglary (with Theft) can be additionally taken.

It is generally a good practice to have your property insured against the damage caused by all the possible perils that can casuse serious financial loss to you. Importantly, such an insurance is also mndatory if there is any loan against the property.

In addition, Burglary insurance is a very useful insurance instrument that provides an extra layer of protection to your property against any loss due to forced break-in. Theft extension can be taken but 24*7 Guard or CCTV are prerequisites for it. Both Burglary / Burglary & theft are issued in addition to the Standard Fire Insurance policy and not as a stand-alone insurance policy.

Now, how can you increase the scope of your fire insurance?

Well, you can increase the scope of your standard fire and burglary insurance with the following add-ons;

- Architects, Surveyors, and Consulting Engineers fees (in excess of 3% of the claim amount)

- Debris Removal (in excess of 1% of the claim amount)

- Deterioration of Stock in Cold Storage

- Forest Fire

- Impact Damage by insured's own vehicles etc.

- Spontaneous combustion

- Omission to insure Additions, Alterations, or Extensions

- Spoilage Material Damage Cover

- Leakage and Contamination Cover

- Loss of Rent

- Additional expenses on rent for Alternative Accommodation

- Start-Up Expenses

In conclusion, a standard fire and special perils policy is a comprehensive insurance plan that one must-have. It covers your insured items from the risk of being destroyed in a fire or by an act of gods under the special perils cover.

Standard fire and special perils policy is assures you against a host of possible risks and their premiums are also quite reasonable.

Most of the perils are covered as an integral part of the basic policy and a host of add-on covers are also available to opt from depending on the individual requirement. So one can customize the policy according to the individual risks his/her assets are exposed to and pay the premium accordingly